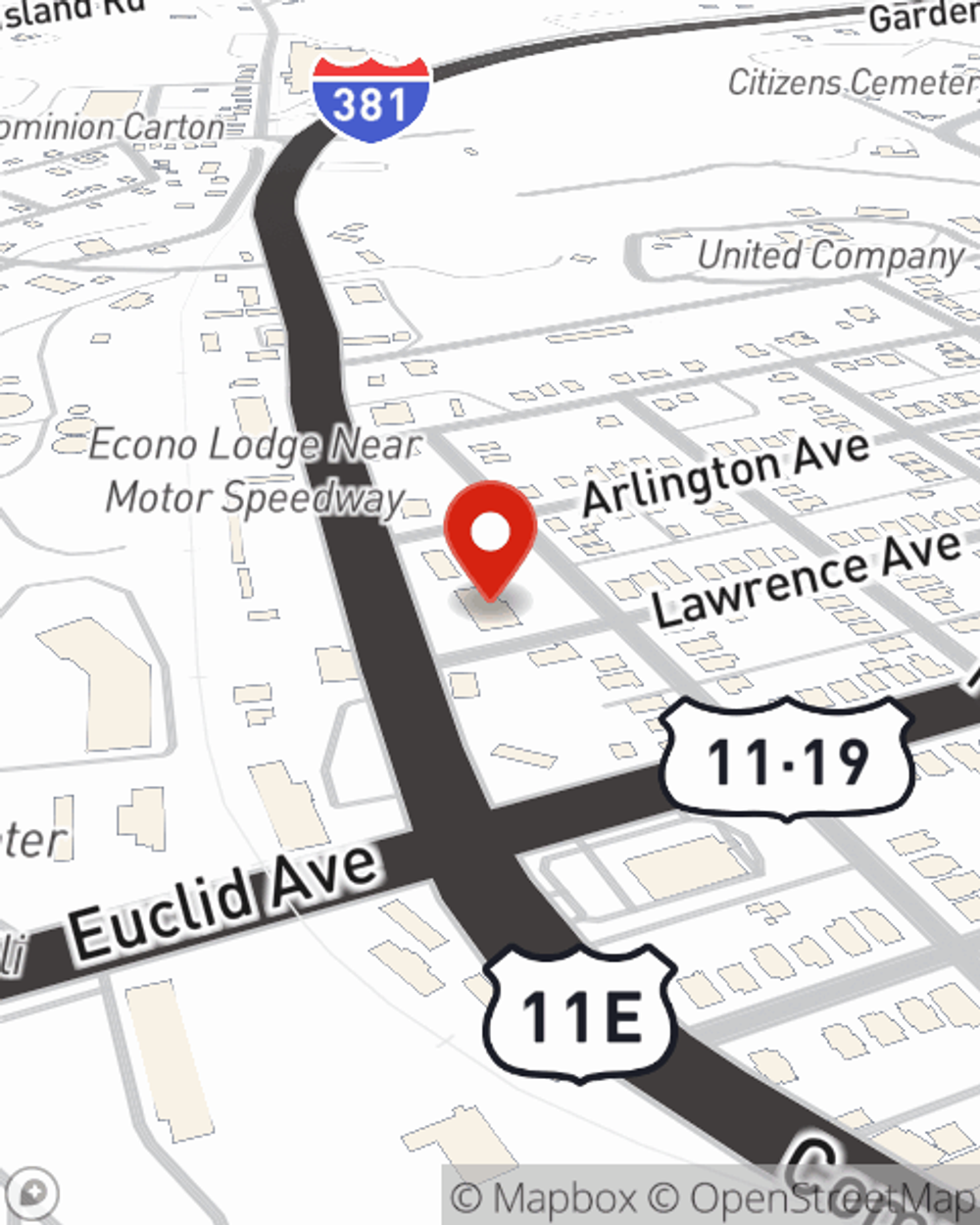

Renters Insurance in and around Bristol

Looking for renters insurance in Bristol?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Washington County

- Bristol, VA & TN

- Abingdon

- Sullivan County

- Tri Cities Area

- Mendota

- Gate City

- Russell County

- Glad Spring, VA

- Kingsport, TN

- Johnson City, TN

Protecting What You Own In Your Rental Home

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your couch to your golf clubs. Wondering how much coverage you need? We have answers! Tim Burnette is here to help you evaluate your risks and help find insurance that is reliable and a good fit today.

Looking for renters insurance in Bristol?

Renters insurance can help protect your belongings

Why Renters In Bristol Choose State Farm

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Bristol. Call or email agent Tim Burnette's office to talk about a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Tim at (276) 669-0517 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Tim Burnette

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.